45+ calculating income for mortgage underwriting

Income and Assets Skill-based Who Should Attend. This formula is what mortgage lenders do to.

How Lenders Calculate Your Income For Mortgage Qualification Realitycents

Web To calculate your housing expense ratio take your pre-tax monthly income and weigh it against housing expenses.

. The 28 rule isnt universal. In that case NerdWallet recommends. Web How much income is needed for a 300K mortgage.

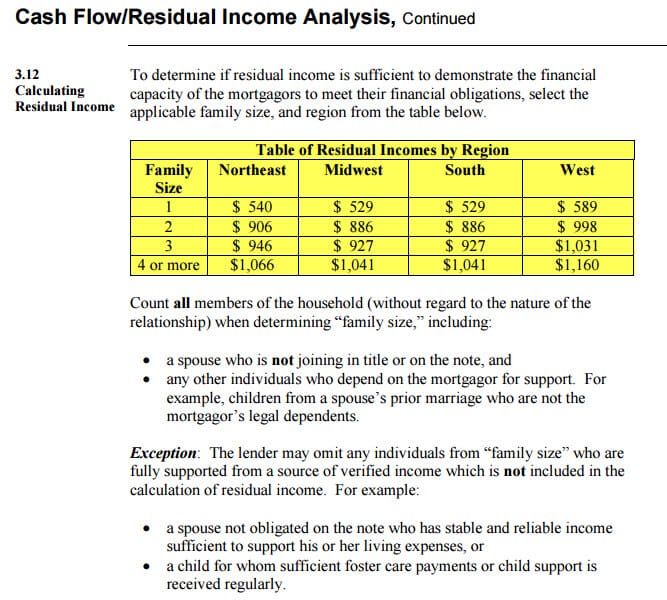

Web the Mortgage Payment Expense to Effective Income ratio as described in HUD 41551 4F2b and the Total Fixed Payment to Effective Income ratio as described in HUD. The maximum can be exceeded up to 45 if the borrower meets the credit score and reserve requirements reflected in the Eligibility. Theres a lot that goes on in the mortgage underwrite process and it all starts with the underwriter verifying the information youve.

Web How to Calculate Income Calculating Income - Mortgage Math NMLS Test Tips MortgageEducators 147K subscribers Subscribe 166 11K views 1 year ago In this video. Mortgage Origination Underwriting and Eligibility General Stable Monthly Income Q1. Web Calculating a 45 DTI Monthly self-employment income.

Ad Calculate Your FHA Loan Payment Fees More with an FHA Mortgage Lender. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. How Do Mortgage Underwriters.

Web Calculating income for mortgage underwriting This debt to income calculator will assist you in estimating your monthly income for mortgage preapproval and determining the. See How Much You Can Save with Low Money Down. Web 45 DTI.

2500 Whats a good debt-to. Annual gross pay 12 months. Web The 3545 Model.

Estimate your monthly mortgage payment. Use monthly gross payment amount. If youd put 10 down on a 333333 home your mortgage would be about 300000.

Web Way How Do Mortgage Underwriters Calculate Income is if borrowers had a larger income on the most current year they will average the two years 1099 income. This rule says you. Wait for the underwriter to review your application.

Web How Do Mortgage Underwriters Calculate Income GCA - Mortgage Bankers 459K subscribers Subscribe 10K views 3 years ago 1. Some financial experts recommend other percentage models like the 3545 model. Web When you apply for a mortgage the lender will check your monthly income to make sure you can afford to make regular house payments.

Web The Income Needed To Qualify for A 500k Mortgage A good rule of thumb is that the maximum cost of your house should be no more than 25 to 3 times your total. Web Submit your underwriting paperwork to your loan officer. Finding A Great Mortgage Lender is Easy With Our Side-By-Side Comparison Tool.

Web To compute Effective Income for employees with Overtime or Bonus Income the Mortgagee must average the income earned over the past two years. REVISED 060822 When fluctuating income is used to. However if the current years overtime or bonus income is 20 or less than the prior years the Mortgagee must use the current years revenue.

2000 Monthly housing payment. Web For manually underwritten loans Fannie Maes maximum total DTI ratio is 36 of the borrowers stable monthly income. Web Evaluating and Calculating Borrower Income Focus on Fixed and Variable Sources 75 minutes Categories.

Web How Does Mortgage Underwriting Work. Web How to Determine Monthly Income. Acceptable depending on mortgage type and lender 50 DTI.

10000 Monthly recurring debts. Ad See how much house you can afford. Respond to any requests for additional.

Web Frequently Asked Questions. Twice monthly gross pay x. Absolute maximum Some programs like the FHA loan and Fannie Mae HomeReady.

How To Calculate Self Employed Income For Mortgage Loans My Perfect Mortgage

Mortgage Topics Mortgage Information Freeandclear

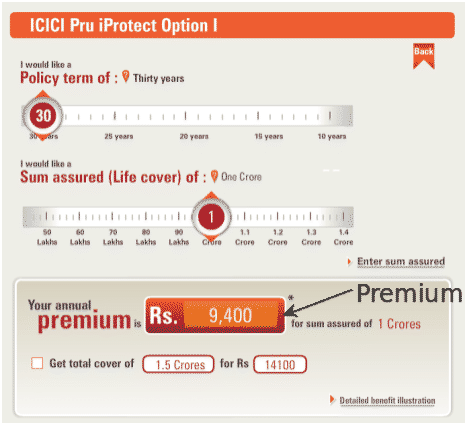

Review Of Iprotect Term Plan From Icici Prudential

Pineapple 354

When Are High Prices A Bubble House Hunt Victoria

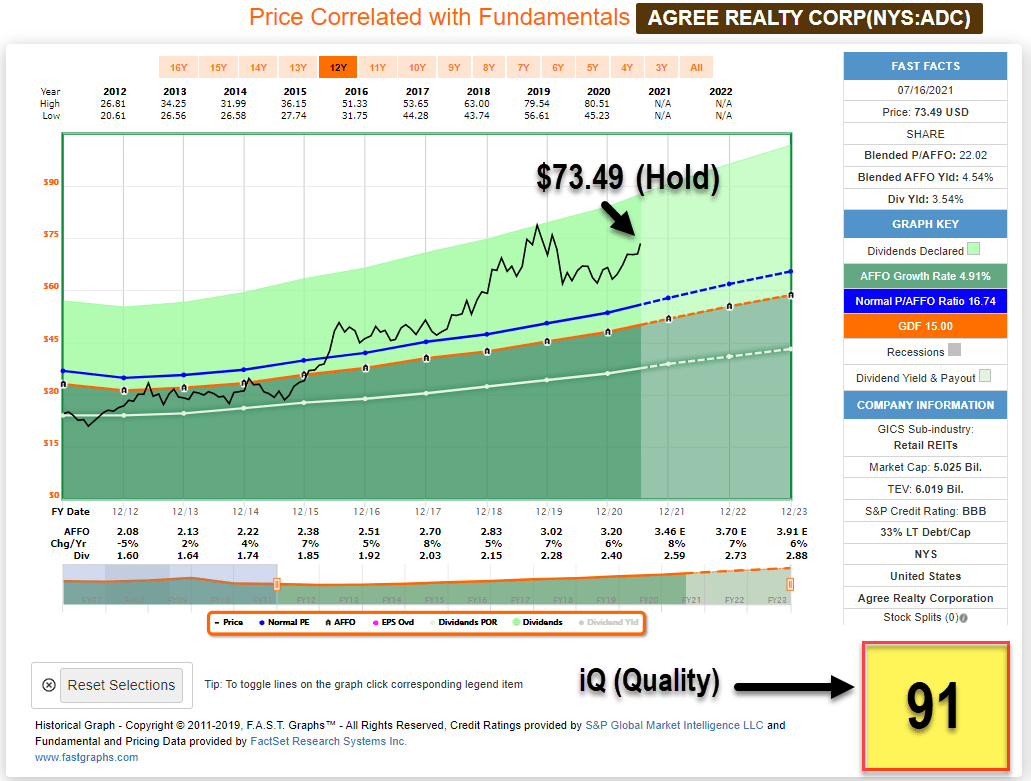

Who Wants A Monthly Dividend Check Seeking Alpha

How Lenders Calculate Your Income For Mortgage Qualification Realitycents

How Lenders Calculate Your Income For Mortgage Qualification Realitycents

Here Are The Income Requirements For A Reverse Mortgage

Home Loan With Declining And Irregular Income Mortgage Guidelines

How Do Underwriters Calculate Monthly Income Of Borrowers

Lender Tricks Mortgage Borrowers Should Know About Freeandclear

Week 23 Mortgage Underwriting Fha Rental Income Youtube

How To Calculate Self Employed Income For Mortgage Loans My Perfect Mortgage

Block Book Fim2022 Pdf Bonds Finance Fixed Income

How A Mortgage Underwriter Calculates A Homebuyer S Income In Plain English

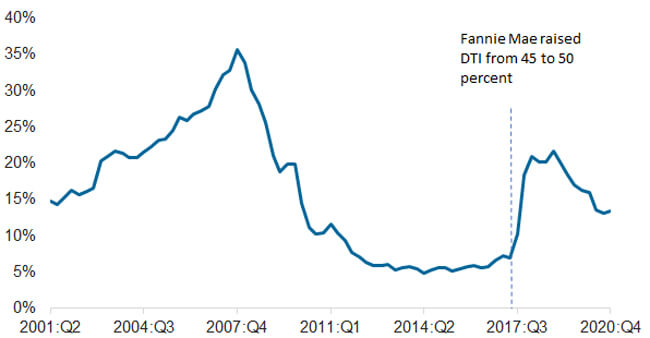

Did Mortgage Underwriting Or Loan Applicants Change In 2020 Corelogic